Let’s Connect

RKCA is an organization excelled by its Competency Centers with more than 5 decades of presence in India, having a global footprint with associates in more than 90+ countries. Our Purpose is to mentor Entities of today to be MNC’s for tomorrow.

Our Presence

Our Values

-

Responsibility

Towards profession

-

Knowledge

In people

-

Commitment

For Clients

-

Accountability

to Society

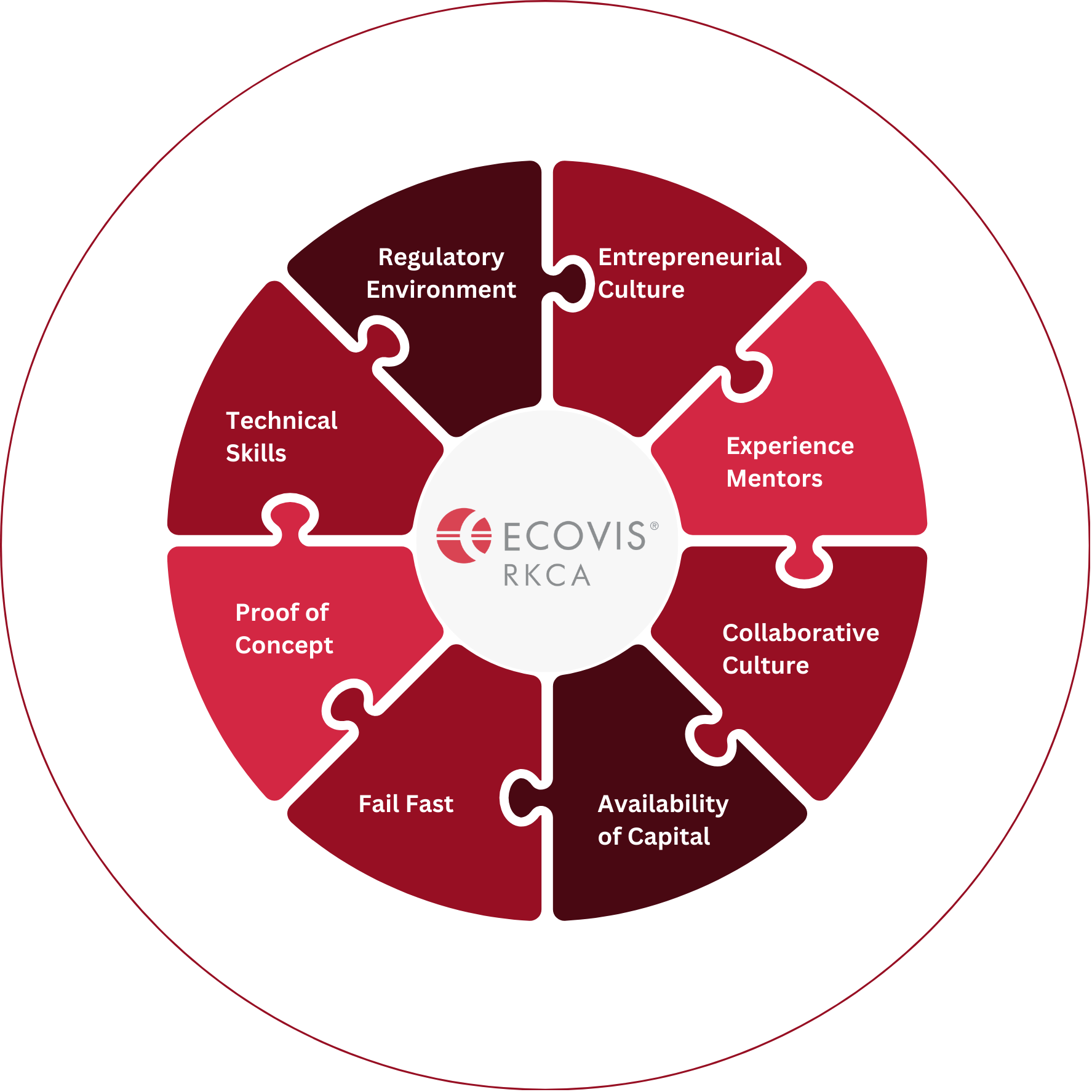

Growth Ecosystem

At our core, we see ourselves as growth partners, not just advisors. Scaling a business in today's dynamic landscape demands a solid foundation built on four key pillars: Technology, Strategy, Governance, and Capital.

Scaling a business requires four essential pillars: technology, strategy, governance, and capital. Gb Tech powers innovation with tech, Core Creators drives growth through strategic performance, Ecovis RKCA ensures governance and compliance, and Margom fuels ventures with capital. Together with our trusted associates, we deliver everything your business needs to succeed and thrive.